Balance Sheet

The “Statement of Financial Position” which reveals the money value of company’s assets, liabilities and owners’ equity (Net Worth) on a particular day is known as the balance sheet.

Equity and Liability

1. Shareholders’ Funds

a) Share Capital

b) Reserves and Surplus

c) Money received against share warrants

2. Share application money pending allotment

3. Non-current Liabilities

a) Long-term borrowings

b) Deferred tax liabilities

c) Other Long-term liabilities

d) Long-term provisions

4. Current Liabilities

a) Short-term borrowings

b) Trade payables

c) Other current liabilities

d) Short-term provisions

Assets

1. Non-current Assets

a) Fixed assets

i. Tangible assets

ii. Intangible assets

iii. Capital work in progress

iv. Intangible assets under development

b) Non-current investments

c) Deferred tax assets

d) Long-term loan and advances

e) Other non-current assets

2. Current Assets

a) Current Investments

b) Inventories

c) Trade receivables

d) Cash and cash equivalents

e) Short-term loans and advances

f) Other current assets

Balance Sheet and Banker

A bank will not approve credit unless the balance sheet and financial statement reveal that the company has:

A Sound financial position (Solvency Test)

Good liquidity (Cash Flows)

A good earning capacity (Profitability)

Current Liabilities Include

Short term borrowing form Banks and Others

Unsecured Loans

Public Deposits maturing within one year

Sundry creditors

Interest & other charges accrud but not due for payment

Advance payments from customers

Deposits from Dealer, selling agent etc.

Instalment of term loan and long term deposits payable witn one year

Statutory Liabilities

Misc. Current Liabilities

Current Assets Includes

Cash and Bank Balances

Investments

Receivables other than deferred receivables

Installments of deferred receivable due within one year

Raw materials and components used in manufacturing

Semi finished & finished goods

Other consumable spares

Advance payment for tax

Pre-paid expenses

Advance for purchase raw materials

Receivable from contracted sales of fixed assets

Profit & Loss Account

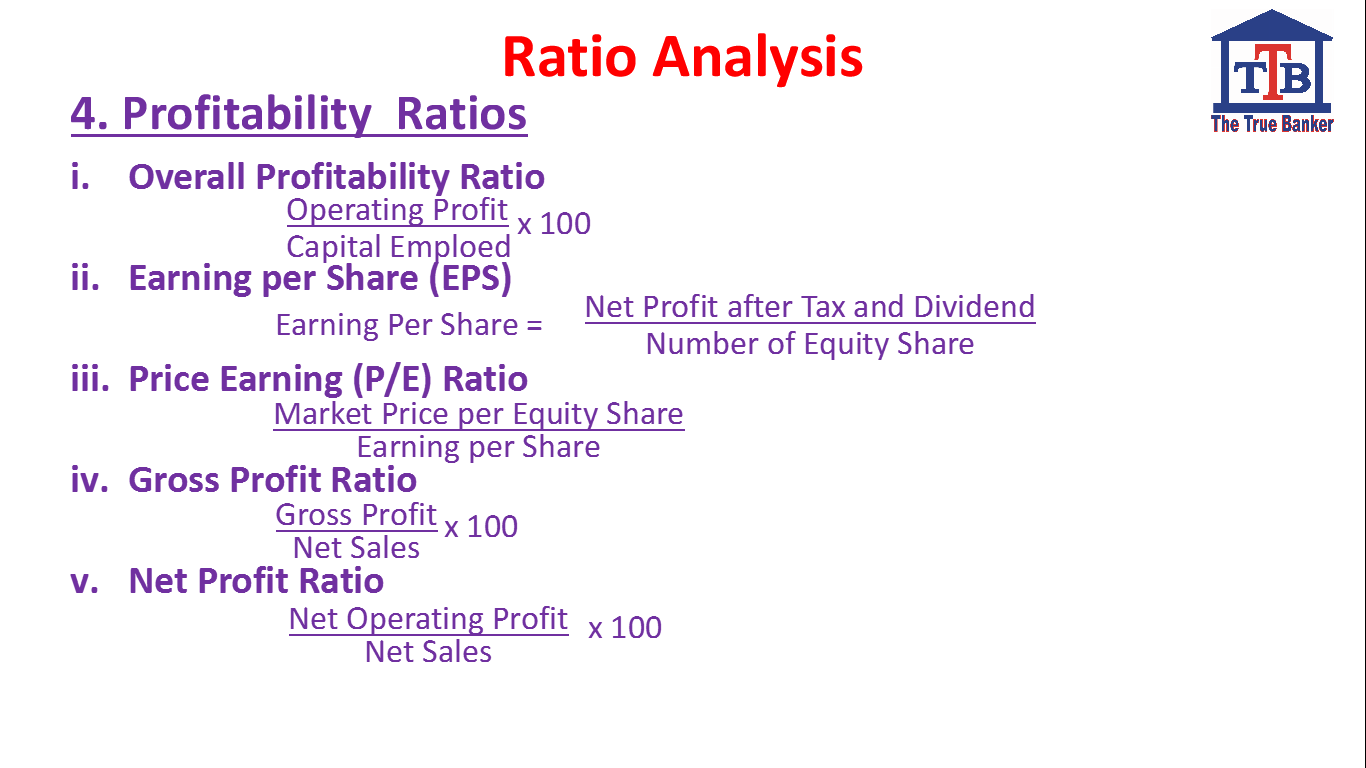

Gross Profit = Profit before Depreciation, Tax and other appropriating expenses

Net Profit = Profit after Depreciation, Tax and other appropriating expenses

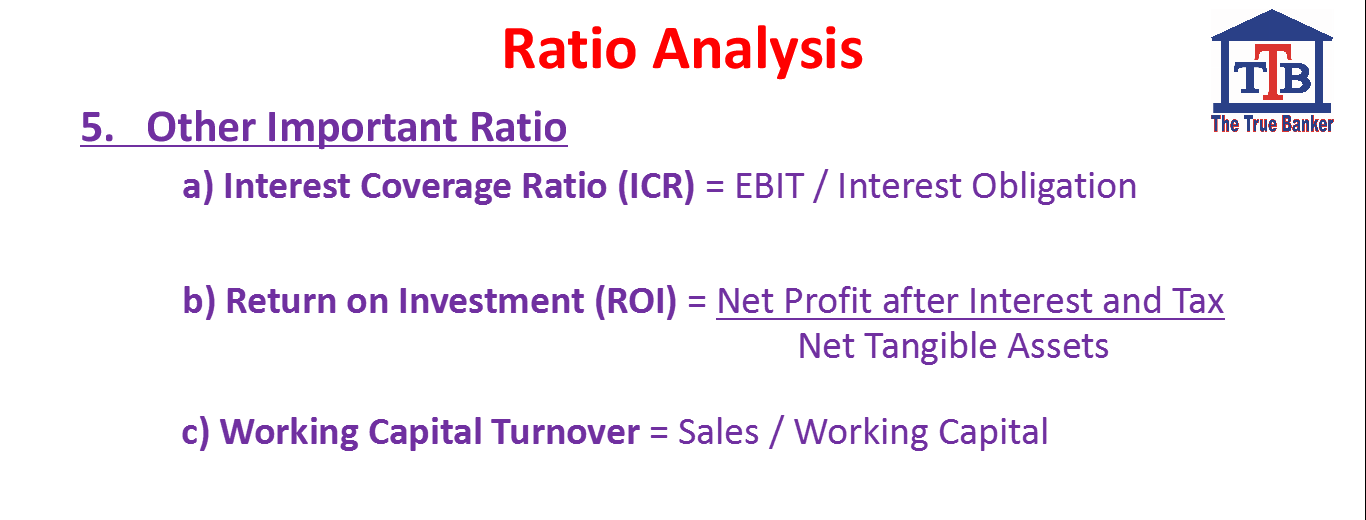

Return on Equity = Net Profit/Equity

Return on Investment = Net Profit/Shareholder’s Funds

Net Worth = Paid up capital + General Reserve + Surplus – Intangible Assets

Net Working Capital = Current Assets – Current Liabilities

Working Capital Gap = Current Assets – Current Liabilities other than Bank Borrowings