INTRODUCTION:

The world is increasingly getting inter connected and complex. Bank credit mechanism has also undergone phenomenal changes in recent years. Few years ago, credit meant only Cash Credit, Overdraft and Loan. Today quasi credit facilities like Letters of Credit, Bank Guarantees, Co acceptances, Buyer’s Credit and Supplier’s Credit are gaining predominance. The bank officer dealing with such products should possess a good knowledge of the product itself to assess the risk involved and judge the repayment capacity of the borrower to honour the liabilities within the agreed timeframe. Credit Appraisal and Risk Appraisal can be considered as two sides of the same coin. Hence, when appraisal aspects are being discussed, be it concerning domestic finance or trade finance for international trade, risk aspects are considered so that the credit officer does not lose sight of the same. The course provides a holistic insight into the various dimensions in bank credit management.

OBJECTIVES:

- To develop a cadre of credit officers in banks to perform different credit functions across banks

- To inculcate advanced skills for handling credit management issues

COVERAGE:

The course broadly covers:

- Loan Policy

- Credit appraisal

- Analysis of Financial statements

- Project Finance

- Working Capital Management

- Export Credits

- Credit Monitoring

- Management of Impaired Assets etc

TARGET GROUP:

- Existing/ Newly posted officers in credit department

- Persons identified for the credit department

- People aspiring to become credit officers in banks

METHODOLOGY:

Course has two components viz.,

- Online examination for 100 marks based on a specially designed courseware on credit management

- Classroom Training of 3 days

For details of Classroom Training, Course Structure & Delivery, refer

ELIGIBILITY:

- Members and Non-Members of the Institute

- Candidates must have passed the 12th standard examination in any discipline or its equivalent.

SUBJECT OF ONLINE EXAMINATION:

Credit Management

PASSING CRITERIA:

- Minimum marks for pass in the subject is 50 out of 100 for online examination.

- Minimum 25 marks for pass out of 50 marks in the Classroom training.

EXAMINATION/ TRAINING FEES: (For Members/ For Non-members)

Sr. No. | Particulars | Examination Fee | Training Fee** | Total Examination + Training Fee |

1. | Virtual training mode | Rs. 6,000/- plus GST | Nil | Rs. 6,000/- plus GST |

2. | Physical classroom training mode at Mumbai, Delhi, Chennai and Kolkata centres | Rs. 6,000/- plus GST | Rs. 5,000/- plus GST | Rs. 11,000/- plus GST |

3. | Physical classroom training mode at other centres | Rs. 6,000/- plus GST | Rs. 9,000/- plus GST | Rs. 15,000/- plus GST |

Please Note: Candidates are required to Register for every attempt separately.

The fee once paid will NOT be refunded or adjusted on any account.

- Training fees are to be paid after the candidate clears the online examination conducted by the Institute.

- Candidates, who do not pass the online examination in their first attempt, need to enroll for the second attempt by paying a nominal fee of Rs.200.

- Candidates who do not pass the online examination in their second attempt, need to enroll again by paying a fee of Rs. 6,000/-.

- If a candidate fails in the virtual classroom training, he/she can enroll for the second attempt by paying a fee of Rs. 1,000/- plus GST.

MEDIUM OF EXAMINATION:

Examination will be conducted in English only.

PATTERN OF EXAMINATION:

(i) Question Paper will contain 100 objective type multiple choice questions including situation analysis/ problem based questions for a total of 100 marks

(ii) The examination will be held in Online Mode only

(iii) There will NOT be negative marking for wrong answers.

DURATION OF EXAMINATION:

The duration of the examination will be of 2 hours.

PERIODICITY AND EXAMINATION CENTRES:

- Examination will be conducted on pre-announced dates published on IIBF Web Site. Institute conducts examination on half yearly basis, however periodicity of the examination may be changed depending upon the requirement of banking industry.

- List of Examination centers will be available on the website. (Institute will conduct examination in those centers where there are 20 or more candidates.)

PROCEDURE FOR APPLYING FOR EXAMINATION

Application for examination should be registered online from the Institute’s website www.iibf.org.in. The schedule of examination and dates for registration will be published on IIBF website.

PROOF OF IDENTITY

Non-members applying for Institute’s examinations/courses are required to attach/ submit a copy of any one of the following documents containing Name, Photo and Signature at the time of registration of Examination Application. Application without the same shall be liable to be rejected.

1) Photo ID Card issued by Employer or 2) PAN Card or 3) Driving Licence or 4) Election Voter’s ID Card or 5) Passport 6) Aadhaar Card

CUT-OFF DATE OF GUIDELINES/ IMPORTANT DEVELOPMENTS FOR EXAMINATIONS

The Institute has a practice of asking questions in each exam about the recent developments/ guidelines issued by the regulator(s) in order to test if the candidates keep themselves abreast of the current developments. However, there could be changes in the developments/ guidelines from the date the question papers are prepared and the dates of the actual examinations.

In order to address these issues effectively, it has been decided that:

- In respect of the examinations to be conducted by the Institute for the period February to July of a calendar year, instructions/ guidelines issued by the regulator(s) and important developments in banking and finance up to 31st December will only be considered for the purpose of inclusion in the question papers”.

- In respect of the examinations to be conducted by the Institute for the period August to January of a calendar year, instructions/ guidelines issued by the regulator(s) and important developments in banking and finance up to 30th June will only be considered for the purpose of inclusion in the question papers.

COURSE STRUCTURE & DELIVERY

Certified Credit Professional has two parts viz. written examination and class room training. To be declared successful, a candidate has to secure a minimum of 50% marks in the online examination and 50% in class room training. The steps in completing the course are as under:

- Study:

A minimum 3 months’ study of the stipulated courseware is envisaged. Institute will accept application up to a certain period before the dates of announced exams so as to ensure that the study period is adhered to.

- Examination:

Candidates will have to appear for the online examination conducted by IIBF (Multiple Choice Questions mode) and pass the examination.

- Training:

Candidates who have successfully passed the online examination have to undergo training. For this purpose, the candidate, on passing the examination should log on to IIBF website – www.iibf.org.in and select his/her convenient slot for classroom/virtual classroom training (3 days) from the pre-determined dates and venue (in case of classroom training) at select centres announced by the Institute. During the classroom/virtual classroom training, candidates will be assessed (Internal assessment) for training performance for a total of 50 marks. Marks for training will be awarded to candidates by faculty for their training participation, analytical skills, case discussions, dealing ability, presentation skills etc.

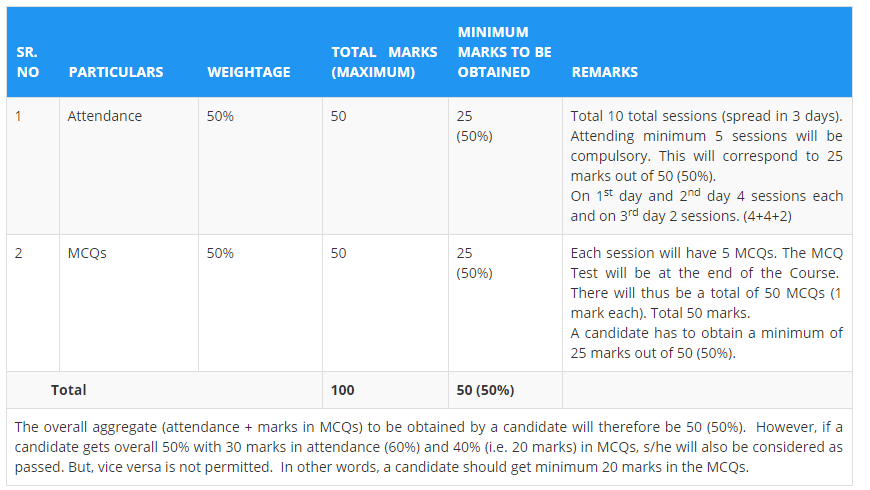

Evaluation Process:

- Time Limit for Training:

- Virtual Class Room Training is required to be completed within 15 months from the date of declaration of the online examination results in which the candidate passes.

- In case a candidate fails to complete the training either on account of not able to successfully complete the training or by not attending training within the stipulated period of 15 months, the candidate would be required to RE-ENROLL himself for the Online examination foregoing credit for the subject/s passed in the Online examination earlier in case he wants to complete the course.

AWARD OF CERTIFICATE:

Certificate will be issued to candidates within 2 months on successful completion of both online examination and classroom training. No certificate will be issued for passing only the online examination.