Chapter 3 – Risk Regulation In Banking Industry

Basel I

Basel I refers to a set of international banking regulations created by the Basel Committee on Bank Supervision (BCBS), which is based in Basel, Switzerland. The committee defines the minimum capital requirements for financial institutions, with the primary goal of minimizing credit risk. Basel I is the first set of regulations defined by the BCBS and is a part of what is known as the Basel Accords, which now includes Basel II and Basel III. The accords’ essential purpose is to standardize banking practices all over the world.

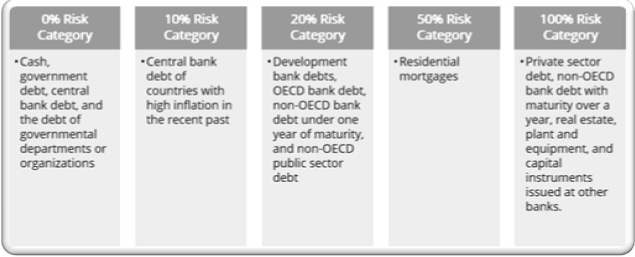

Bank Asset Classification System

The Bank Asset Classification System classifies a bank’s assets into five risk categories on the basis of a risk percentage: 0%, 10%, 20%, 50%, and 100%. The assets are classified into different categories based on the nature of the debtor, as shown below:

Implementation

Basel I primarily focuses on credit risk and risk-weighted assets (RWA). It classifies an asset according to the level of risk associated with it. Classifications range from risk-free assets at 0% to risk assessed assets at 100%. The framework requires the minimum capital ratio of capital to RWA for all banks to be at 8%.

Tier 1 capital refers to capital of more permanent nature. It should make up at least 50% of the bank’s total capital base. Tier 2 capital is temporary or fluctuating in nature.

Benefits of Basel I

- Significant increase in Capital Adequacy Ratios of internationally active banks

- Competitive equality among internationally active banks

- Augmented management of capital

- A benchmark for financial evaluation for users of financial information

Basel II

Basel II is the second set of international banking regulations defined by the Basel Committee on Bank Supervision (BCBS). It is an extension of the regulations for minimum capital requirements as defined under Basel I. The Basel II framework operates under three pillars:

- Capital adequacy requirements

- Supervisory review

- Market discipline

The Three Pillars under Basel II

Pillar 1: Capital Adequacy Requirements

Pillar 1 improves on the policies of Basel I by taking into consideration operational risks in addition to credit risks associated with risk-weighted assets (RWA). It requires banks to maintain a minimum capital adequacy requirement of 8% of its RWA. Basel II also provides banks with more informed approaches to calculate capital requirements based on credit risk, while taking into account each type of asset’s risk profile and specific characteristics. The two main approaches include the:

- Standardized approach

The standardized approach is suitable for banks with a smaller volume of operations and a simpler control structure. It involves the use of credit ratings from external credit assessment institutions for the evaluation of the creditworthiness of a bank’s debtor.

- Internal ratings-based approach

The internal ratings-based approach is suitable for banks engaged in more complex operations, with more developed risk management systems. There are two IRB approaches for calculating capital requirements for credit risk based on internal ratings:

- Foundation Internal Ratings-based approach (FIRB): In FIRB, banks use their own assessments of parameters such as the Probability of Default, while the assessment methods of other parameters, mainly risk components such as Loss Given Default and Exposure at Default, are determined by the supervisor.

- Advanced Internal Ratings-based approach (AIRB): Under the AIRB approach, banks use their own assessments for all risk components and other parameters.

Pillar 2: Supervisory Review

Pillar 2 was added owing to the necessity of efficient supervision and lack thereof in Basel I, pertaining to the assessment of a bank’s internal capital adequacy. Under Pillar 2, banks are obligated to assess the internal capital adequacy for covering all risks they can potentially face in the course of their operations. The supervisor is responsible for ascertaining whether the bank uses appropriate assessment approaches and covers all risks associated.

- Internal Capital Adequacy Assessment Process (ICAAP): A bank must conduct periodic internal capital adequacy assessments in accordance with their risk profile and determine a strategy for maintaining the necessary capital level.

- Supervisory Review and Evaluation Process (SREP): Supervisors are obligated to review and evaluate the internal capital adequacy assessments and strategies of banks, as well as their ability to monitor their compliance with the regulatory capital ratios.

- Capital above the minimum level: One of the added features of the framework Basel II is the requirement of supervisors to ensure banks maintain their capital structure above the minimum level defined by Pillar 1.

- Supervisor’s interventions: Supervisors must seek to intervene in the daily decision-making process in order to prevent capital from falling below the minimum level.

Pillar 3: Market Discipline

Pillar 3 aims to ensure market discipline by making it mandatory to disclose relevant market information. This is done to make sure that the users of financial information receive the relevant information to make informed trading decisions and ensure market discipline.

Basel III

The Basel III accord is a set of financial reforms that was developed by the Basel Committee on Banking Supervision (BCBS), with the aim of strengthening regulation, supervision, and risk management within the banking industry. Due to the impact of the 2008 Global Financial Crisis on banks, Basel III was introduced to improve the banks’ ability to handle shocks from financial stress and to strengthen their transparency and disclosure.

Basel III builds on the previous accords, Basel I and II, and is part of a continuous process to enhance regulation in the banking industry. The accord aims to prevent banks from hurting the economy by taking more risks than they can handle.

The Basel Committee

The BCBS was established in 1974 by the central bank governors of the Group of Ten (G10) countries, as a response to disruptions in financial markets. The committee was set up as a forum where member countries can deliberate on banking supervisory matters. BCBS is responsible for ensuring financial stability by strengthening regulation, supervision, and banking practices globally.

The committee was expanded in 2009 to 27 jurisdictions, including Brazil, Canada, Germany, Australia, Argentina, China, France, India, Saudi Arabia, the Netherlands, Russia, Hong Kong, Japan, Italy, Korea, Mexico, Singapore, Spain, Luxembourg, Turkey, Switzerland, Sweden, South Africa, the United Kingdom, the United States, Indonesia, and Belgium.

The BCBS reports to the Group of Governors and Heads of Supervision (GHOS). Its secretariat is located in Basel, Switzerland, at the Bank for International Settlements (BIS). Since being established, the BCBS has formulated the Basel I, Basel II, and Basel III accords.

Key Principles of Basel III

1. Minimum Capital Requirements

The Basel III accord raised the minimum capital requirements for banks from 2% in Basel II to 4.5% of common equity, as a percentage of the bank’s risk-weighted assets. There is also an additional 2.5% buffer capital requirement that brings the total minimum requirement to 7%. Banks can use the buffer when faced with financial stress, but doing so can lead to even more financial constraints when paying dividends.

As of 2015, the Tier 1 capital requirement increased from 4% in Basel II to 6% in Basel III. The 6% includes 4.5% of Common Equity Tier 1 and an extra 1.5% of additional Tier 1 capital. The requirements were to be implemented starting in 2013, but the implementation date has been postponed several times, and banks now have until January 1, 2022, to implement the changes.

2. Leverage Ratio

Basel III introduced a non-risk-based leverage ratio to serve as a backstop to the risk-based capital requirements. Banks are required to hold a leverage ratio in excess of 3%. The non-risk-based leverage ratio is calculated by dividing Tier 1 capital by the average total consolidated assets of a bank.

To conform to the requirement, the Federal Reserve Bank of the United States fixed the leverage ratio at 5% for insured bank holding companies, and at 6% for Systematically Important Financial Institutions (SIFI).

3. Liquidity Requirements

Basel III introduced the usage of two liquidity ratios – the Liquidity Coverage Ratio and the Net Stable Funding Ratio. The Liquidity Coverage Ratio requires banks to hold sufficient highly liquid assets that can withstand a 30-day stressed funding scenario as specified by the supervisors. The Liquidity Coverage Ratio mandate was introduced in 2015 at only 60% of its stated requirements and is expected to increase by 10% each year till 2019 when it takes full effect.

On the other hand, the Net Stable Funding Ratio (NSFR) requires banks to maintain stable funding above the required amount of stable funding for a period of one year of extended stress. The NSFR was designed to address liquidity mismatches and will start becoming operational in 2018.

Impact of Basel III

The requirement that banks must maintain a minimum capital amount of 7% in reserve will make banks less profitable. Most banks will try to maintain a higher capital reserve to cushion themselves from financial distress, even as they lower the number of loans issued to borrowers. They will be required to hold more capital against assets, which will reduce the size of their balance sheets.

A study by the Organization for Economic Cooperation and Development (OECD) in 2011 revealed that the medium-term effect of Basel III on GDP would be -0.05% to -0.15% annually. To stay afloat, banks will be forced to increase their lending spreads as they pass the extra cost on to their customers.

The introduction of new liquidity requirements, mainly the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR), will affect the operations of the bond market. To satisfy LCR liquid-asset criteria, banks will shy away from holding high run-off assets such as Special Purpose Vehicles (SPVs) and Structured Investment Vehicles (SIVs).

The demand for secularized assets and lower-quality corporate bonds will decrease due to the LCR bias toward banks holding government bonds and covered bonds. As a result, banks will hold more liquid assets and increase the proportion of long-term debts, in order to reduce maturity mismatch and maintain minimum NSFR. Banks will also minimize business operations that are more subject to liquidity risks.

The implementation of Basel III will affect the derivatives markets, as more clearing brokers exit the market due to higher costs. Basel III capital requirements focus on reducing counterparty risk, which depends on whether the bank trades through a dealer or a central clearing counterparty (CCP). If a bank enters into a derivative trade with a dealer, Basel III creates a liability and requires a high capital charge for that trade.

On the contrary, derivative trade through a CCP results in only a 2% charge, making it more attractive to banks. The exit of dealers would consolidate risks among fewer members, thereby making it difficult to transfer trades from one bank to another and increase systemic risk.