Government Bonds

- Bonds issue by Indian government in Indian Rupees are government bonds

- Bonds issue by municipal corporation will not considered as government bonds

- Bonds issued by a national government in foreign currencies are referred to as sovereign bonds

Different kinds of bonds

- Zero Coupon Bonds

These bonds are priced at a nominal value below their face value-and are redeemed at their face value. The investor gets return as difference between the purchase price and face value

- Floating Rate Bonds

When the interest rate can be changed over a time period and yield is linked to current market rate by reset of the interest rate. This ensures that the yield on the bonds is near the current market returns

- Convertible Bonds

These bonds can be converted into shares at a specified rate and time period. Such bonds provide an opportunity to the investor to participate in equity

- Callable Bonds

When the issuer reserves the right to call back the bond and pay a fixed price (may be with premium). Since interest yield declines in such bonds, these are less attractive.

Bond Price and Yield

Coupon rate=8%, Bond-Rs.1000/-, Time-3 year, Presume Rerurn Rate= 5%

PV = 1081.70

When the Market interest rate exceeds the coupon rate, bonds sell for less than face value

When the market interest rate is below the coupon rate, bond sale for more than face value

Yield to maturity

- The total yield on a bond would depend on the capital gains or losses over the time period of the bond.Investors who purchase bonds at premium, have to face capital loss and those who are able to buy it at a discount, earn capital gains.

- Measure return account both current yield and change in a bond’s value over its life

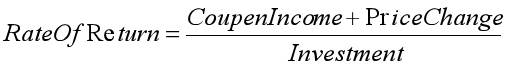

Rate of Return

Rate of Return versus Yield to maturity

- If the bond’s yield to maturity remains unchanged during an investment period, its rate of return will beequal to that

- If the bond’s yield to maturity increases during an investment period, its rate of return will be less than YTM.

- If the bond’s yield to maturity decreases during an investment period, its rate of return will be morethan YTM