Balance Sheet

The “Statement of Financial Position” which reveals the money value of company’s assets, liabilities and owners’ equity (Net Worth) on a particular day is known as the balance sheet.

Equity and Liability

- Shareholders’ Funds

- a) Share Capital

- b) Reserves and Surplus

- c) Money received against share warrants

- Share application money pending allotment

- Non-current Liabilities

- a) Long-term borrowings

- b) Deferred tax liabilities

- c) Other Long-term liabilities

- d) Long-term provisions

- Current Liabilities

- a) Short-term borrowings

- b) Trade payables

- c) Other current liabilities

- d) Short-term provisions

Assets

- Non-current Assets

- a) Fixed assets

- Tangible assets

- Intangible assets

- Capital work in progress

- Intangible assets under development

- b) Non-current investments

- c) Deferred tax assets

- d) Long-term loan and advances

- e) Other non-current assets

- a) Fixed assets

- Current Assets

- a) Current Investments

- b) Inventories

- c) Trade receivables

- d) Cash and cash equivalents

- e) Short-term loans and advances

- f) Other current assets

Balance Sheet and Banker

A bank will not approve credit unless the balance sheet and financial statement reveal that the company has:

- A Sound financial position (Solvency Test)

- Good liquidity (Cash Flows)

- A good earning capacity (Profitability)

Current Liabilities Include

- Short term borrowing form Banks and Others

- Unsecured Loans

- Public Deposits maturing within one year

- Sundry creditors

- Interest & other charges accrud but not due for payment

- Advance payments from customers

- Deposits from Dealer, selling agent etc.

- Installment of term loan and long term deposits payable within one year

- Statutory Liabilities

- Current Liabilities

Current Assets Includes

- Cash and Bank Balances

- Investments

- Receivables other than deferred receivables

- Installments of deferred receivable due within one year

- Raw materials and components used in manufacturing

- Semi finished & finished goods

- Other consumable spares

- Advance payment for tax

- Pre-paid expenses

- Advance for purchase raw materials

- Receivable from contracted sales of fixed assets

Profit & Loss Account

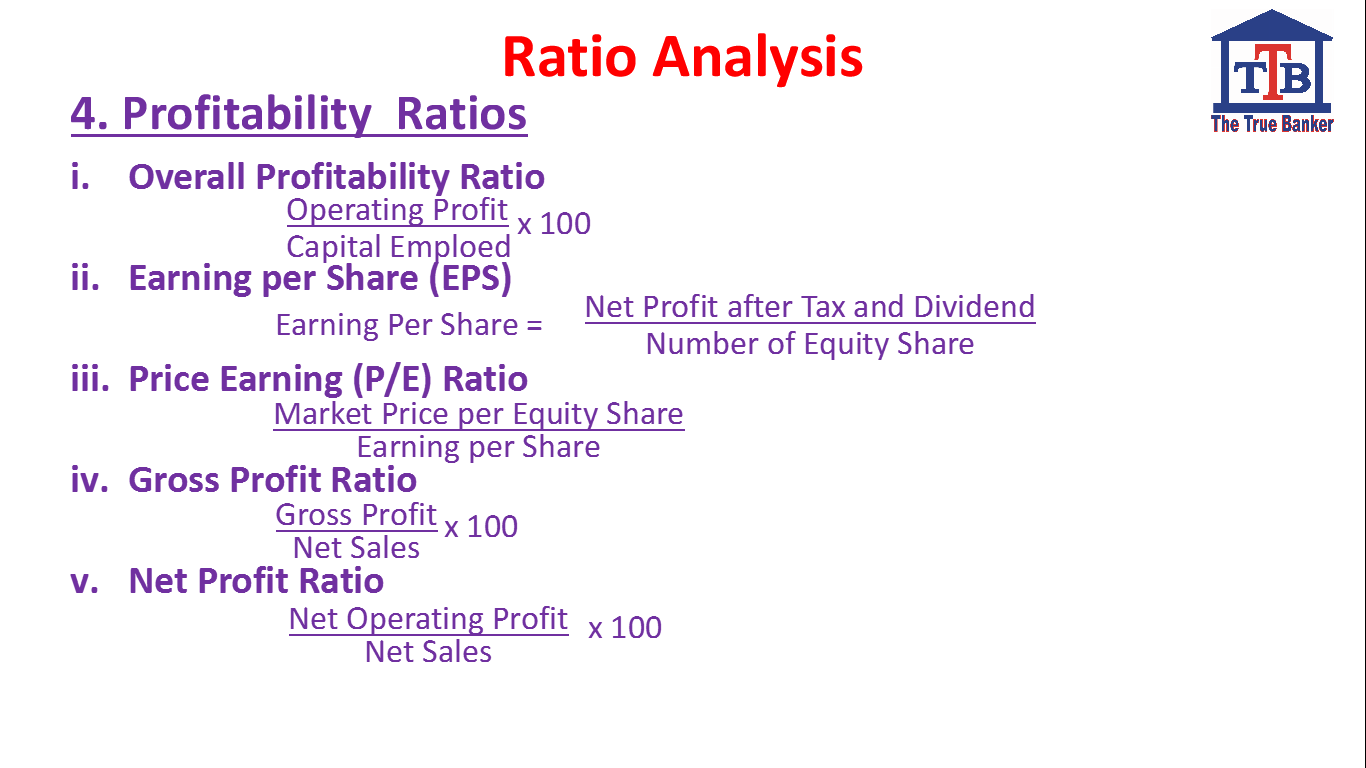

- Gross Profit = Profit before Depreciation, Tax and other appropriating expenses

- Net Profit = Profit after Depreciation, Tax and other appropriating expenses

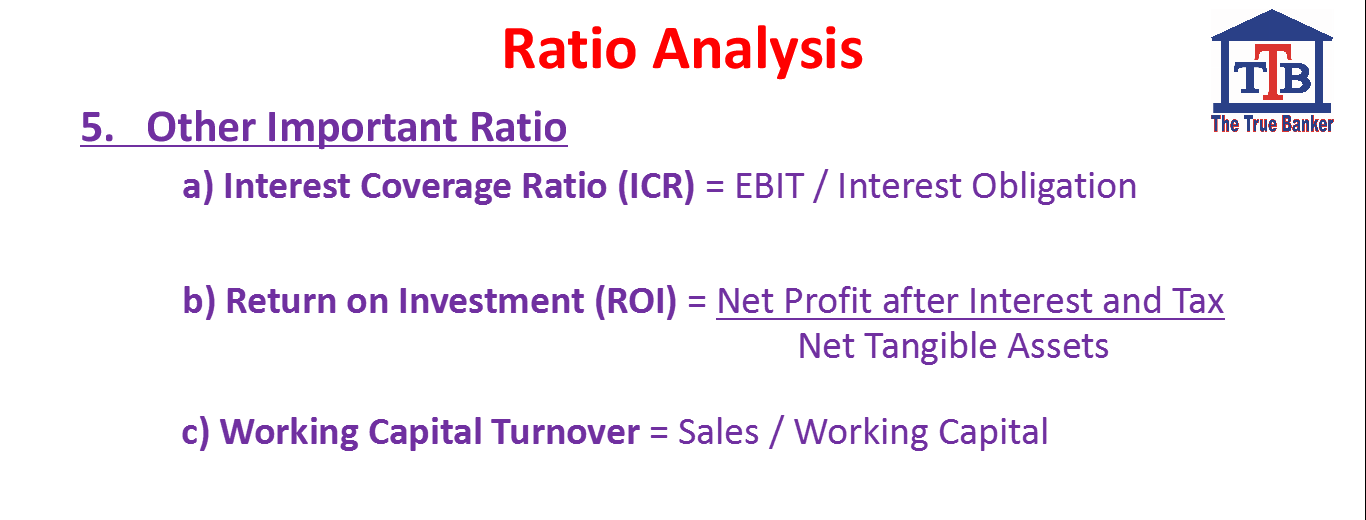

- Return on Equity = Net Profit/Equity

- Return on Investment = Net Profit/Shareholder’s Funds

- Net Worth = Paid up capital + General Reserve + Surplus – Intangible Assets

- Net Working Capital = Current Assets – Current Liabilities

- Working Capital Gap = Current Assets – Current Liabilities other than Bank Borrowings

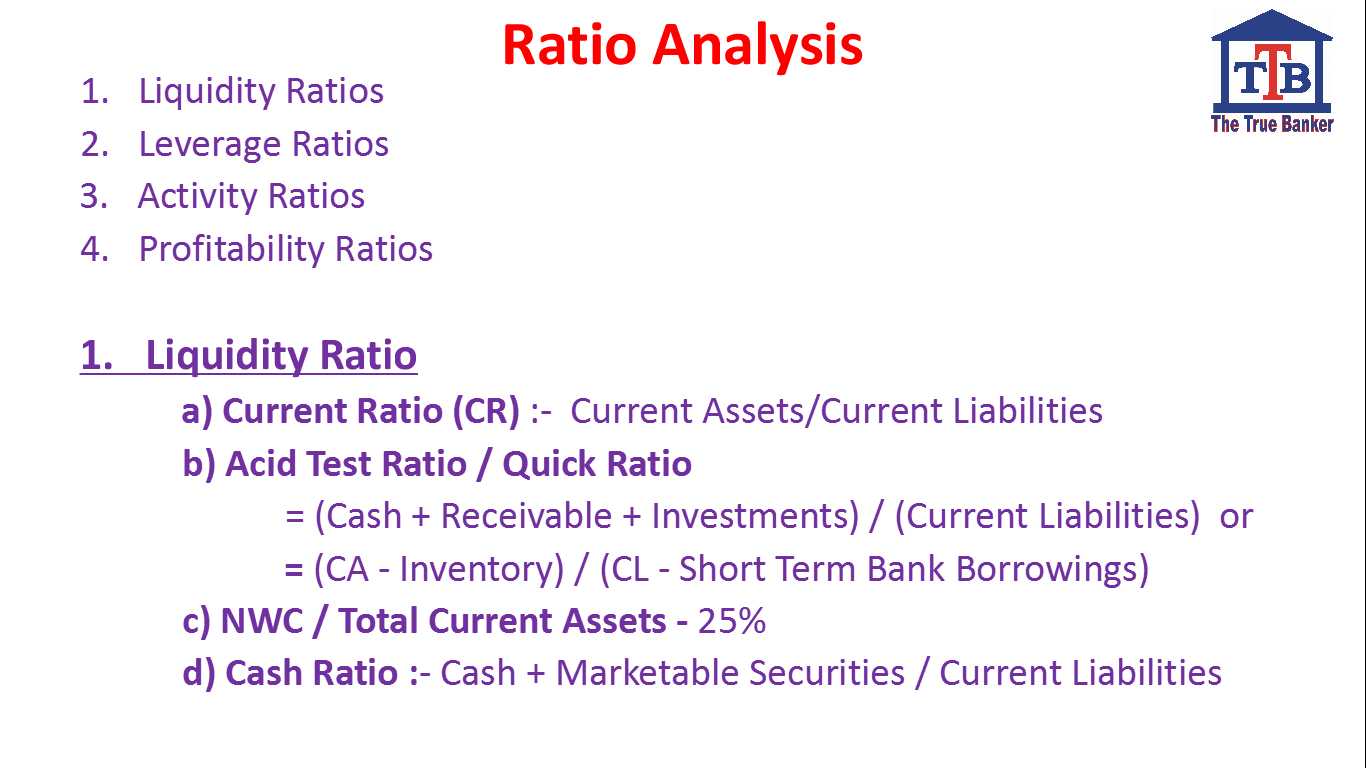

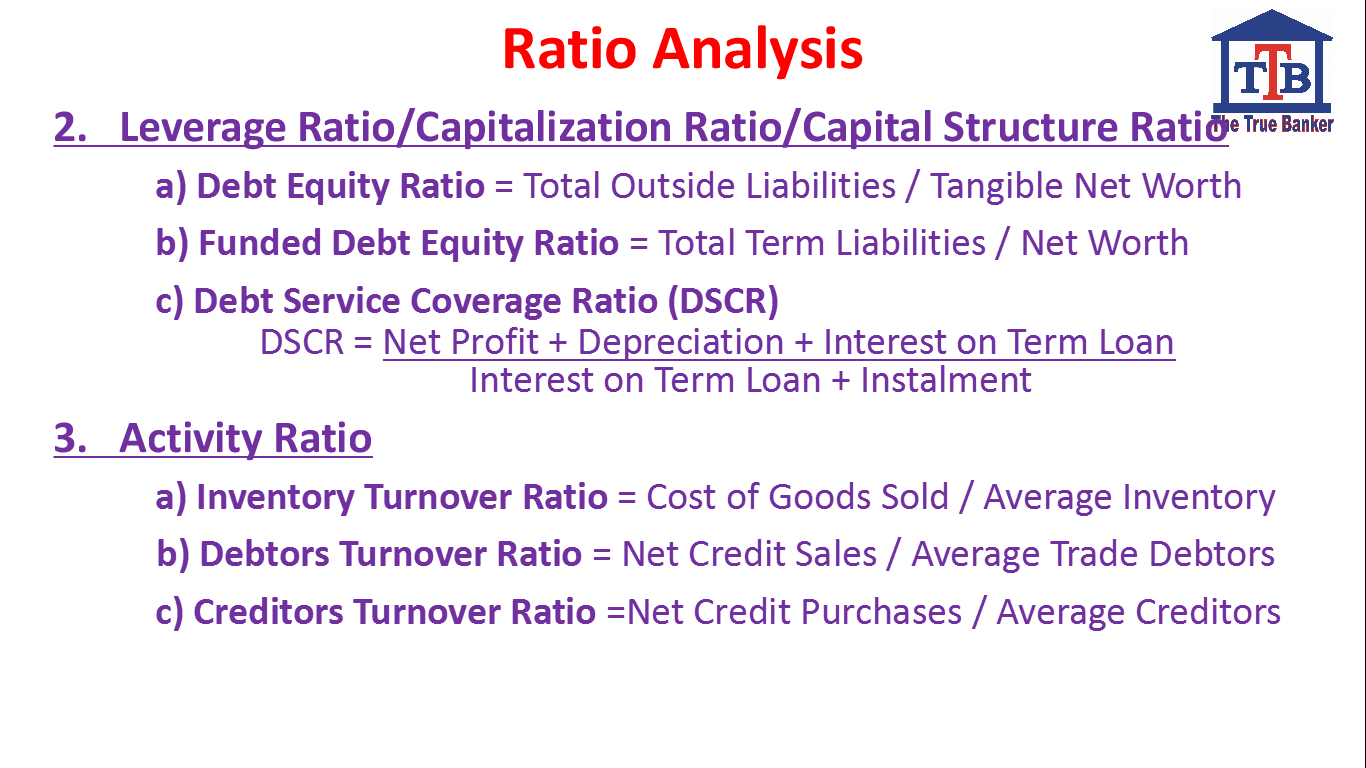

Purpose of Analysis of Financial Statements by Bankers

- Assessment of Performance and Financial Position

- Projection of Future Performance

- Detecting Danger Signals

- Assessment of Credit Requirements

- Examine Funds Flow

- Cross Checking