Time Value of Money

Discounting

Cash flow which is expected to occur in the future, is converted to its present value

Compounding

Cash flow today is converted into its expected future value

Present Value

The present value can be calculated by using the formula

PV = FV/ (1 + r )^n

Future Value

The future value can be calculated by using the formula

FV = PV * (1 + r )^n

Annuity

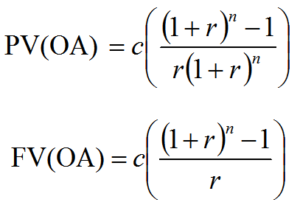

- Ordinary Annuity

– Cash flow at end of the period

- Annuity Due

– Cash flow at beginning of the period

Net Present Value

NPV = Present value of cash inflow – Present value of cash out flow

NPV>0 — Accept

NPV<0 — Reject

NPV=0 — Neutral

Opportunity Cost

– Benchmark for making investment decision

Effective Interest Rate

Effective Interest Rate = ( 1 + r /n )^n – 1